Our Company - WorkForce21 is a nonprofit organization dedicated to helping client customers -- employers and employees alike -- find better ways of developing job access, screening, pre- and post-employment training. We also develop retention based strategies, specifically surrounding child care and transportation.

We are affiliated with Workforce Centers of America, Inc., our nonprofit parent corporation.

With over 35 years experience in developing public/private partnerships for employment and training initiatives, WorkForce21 is well prepared to take on the new challenges facing the business world as a result of changing labor market dynamics.

We are affiliated with Workforce Centers of America, Inc., our nonprofit parent corporation.

With over 35 years experience in developing public/private partnerships for employment and training initiatives, WorkForce21 is well prepared to take on the new challenges facing the business world as a result of changing labor market dynamics.

Our Services - At WorkForce21, we offer our customers customized program design and implementation services surrounding any or all of what you may need. Our service matrix includes: specialized outreach and recruitment, assessment, pre- and post-employment training, transportation and other support services including child care, job coaching and mentoring. Consulting and direct services that bring workforce partners and clients together for success!

Our Promise - WorkForce21 delivers only the very best results backed up by a proven track record and our unconditional guarantee. If you want to simplify the maze of alternative recruitment and support programs in a most cost effective way, with no downside risk and unlimited upside potential, give us a call!

© 2000-2016 Workforce21.net All rights reserved

Or use our Google Service below to search our site or the entire World Wide Web.

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

You envision your workforce goals...we help you achieve them!

| Unemployment Initial (UI) Claims: | 372,000 as of December 29, 2012 |

| Unemployment Rate: | 7.7% in November 2012 |

| Consumer Price Index (CPI): | +0.1% in October 2012 |

| Payroll Employment: | +146,000(p) in November 2012 |

| Average Hourly Earnings: | +$0.04(p) in November 2012 |

| Producer Price Index: | -0.8%(p) in November 2012 |

| (p) preliminary; (c) corrected | |

Latest National Workforce Numbers (at a glance)

Report Summary

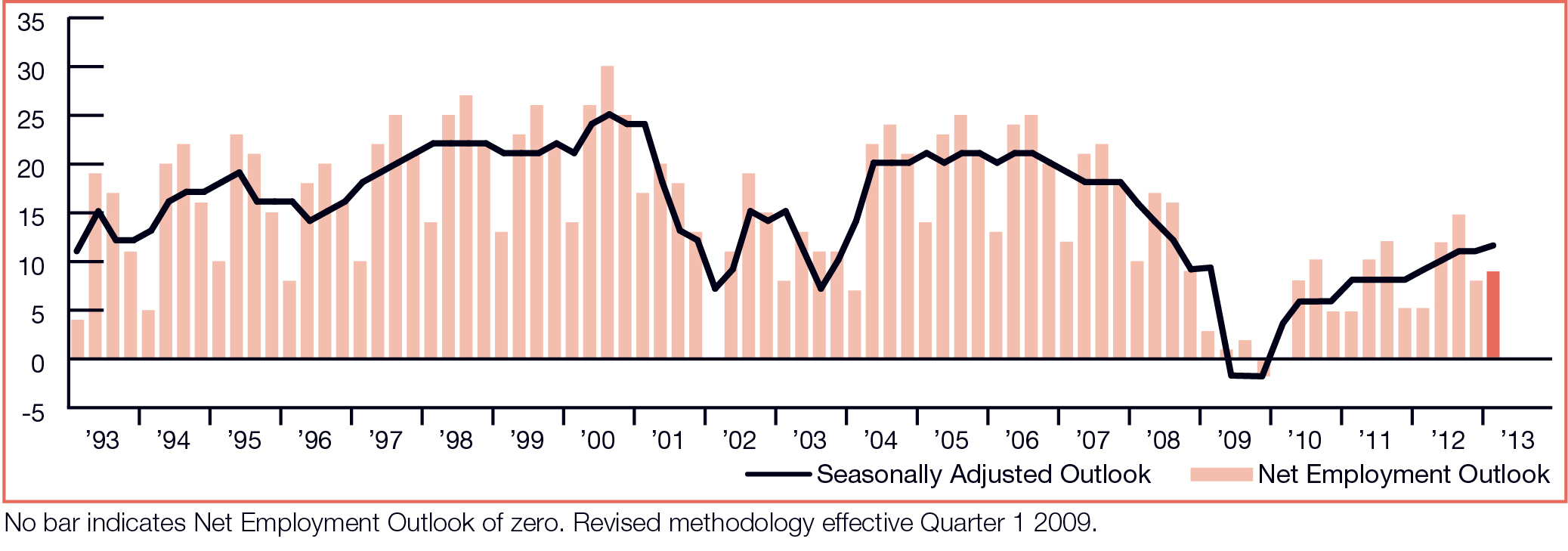

"MANPOWER RELEASES 1st Q 2013 EMPLOYMENT OUTLOOK QUATERLY December 11, 2012"

Go to Report

Employment Outlook

Click graphic for more information

Key Workforce News Headlines

It is the mission of WorkForce21, as stated in its Articles of Incorporation, to "operate exclusively for charitable purposes and provide social, community and community-based economic development programs to assist individuals and families, the elderly, those with disabilities, ex-offenders and ex-substance abusers and others with significant barriers to employment achieve economic success and greater independence of living". The corporation is charged with the responsibility to "develop economic development and vocational preparedness training programs, including needed support services to be based upon the provision, maintenance and operation of such on a non-profit basis." "The purposes for which the corporation is organized and for which it shall exist are to be exclusively charitable in nature within the meaning of section 501(c)(3) of the Internal Revenue Service Code." Specifically, in response to these overall goals, it is the mission of WF21 to:

The various planned functions of the organization will be implemented by personnel to be hired or organizations engaged by the corporation. These include workforce consultants, and specialty organizations in the areas of low income employment program recruitment, intake, assessment, pre-employment and/or business development counseling, life skills training and counseling, job coaching, mentoring, employment related transportation and/or day care services and related property and/or business development.

(Submitted as Addendum to IRS Application Form 1023 [Rev. 9-98] "Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code");

(Submitted as Addendum to IRS Application Form 1023 [Rev. 9-98] "Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code");

O

Provide educational and vocational training and guidance to non-skilled or low-skilled persons who have multiple barriers to employment or are unable to find employment due to inadequate education, or create a non-profit subsidiary of this corporation for the same purpose (51%);

O

Develop new programs and curricula to serve low income populations and families in their quest for economic self-sufficiency, including career counseling, job matching, job readiness, life skills education and/or entreprenueral skills training (10%);

O

Develop, provide or broker support services and programs to help low income populations and families succeed in, retain and advance in employment and microenterprise development, in the form of counseling, job coaching, mentoring, employment related transportation and day care services and other types of training and support services as are understood to be needed by such individuals and families (30%);

O

Construct, operate, maintain, improve, buy, own, sell, convey, assign, mortgage or lease any real property or other personal property necessary to provide such services or indent to the acquisition, ownership, maintenance or operation of low income employment, training or support services and/or the development of low income housing and other social and community facilities, programs and services which shall improve the quality of life and economic development of residents and communities identified in its strategic and business service plan (5%);

O

Solicit, accept and receive grants, contributions and bequests of real and personal property for the use and benefit of developing such aforementioned programs and services (1%);

O

Hold, invest, reinvest and expend such funds and property received for such purposes (1%);

O

Borrow money and issue evidences of indebitness in furtherance of any or all of the objects of its business (1%);

O

Make distributions for charitable purposes, including such purposes as described above, to organizations that qualify as exempt organizations under Section 501(c)(3) of the Code, as amended (1%).

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved

Outreach and Recruitment

Assessment

Pre-Employment Training

Post-Employment Training

Retention-Based Support Services

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved

•

Assessment of current resources, contract service provider.

•

Brokering and improved performance (increased utilization and retention) with Work Opportunity Tax Credits, Welfare to Work Tax Credits, various state tax credits.

•

Direct processing of tax credits at rates less than 15% of credit value!

O

Daily Employee Tracking and Follow-Up

O

Crisis Intervention

O

Employee Assistance Program Design and Management

O

TEA-21 Transportation Demand Management Programming and Employer Tax Credits

O

"Reverse Commute" System Design; Integration with Transportation Management Associations (TMA's) and other transportation resources

O

Operating and Capital Cost Offsets

•

Overall or targeted client assessment of current strategies and needs.

•

On-the-Job Training, skill enhancement and planned upward mobility programming designed and implemented to specification.

•

Integration with existing programs provided by employers.

•

Networking with approved vendors and sources of candidates trained in basic pre-employment skill areas as life skills, GED, ABE, ESL and various basic employment-focused programs.

•

Customized program design based on specific client needs and company policies.

•

Analysis of current systems/instruments for effect and utility.

•

Recommended strategies and validated tools for improved performance.

•

Evaluation of current productive/unproductive sources based on historical production. Networking with successful sources with proven track records on an individual neighborhood basis county-by-county and state-by state.

•

Efficiencies through larger participation in recruitment cooperatives.

•

Use of community-based recruitment techniques with proven results.

•

Overall or targeted client assessment of current strategies and needs. We work with our partners to identify patterns of turnover, costly excessive overtime and vendor agency staffing.

•

Design of a customized plan to address goals, including configuration of resources from government, foundations, community-based and faith-based organizations, all with established track records to deliver for you. We look for brokering resources others miss.

•

Management of all contract service partners. We make it easy and worry-free to work with diverse and community-based partners.

•

Problem solving management as programs develop to guarantee results.

•

Child Care

•

Job Coaching

•

Mentoring

•

Case Management

Tax Credit Services

•

Transportation

General Workforce Programming

•

We will keep client information and records confidential and not use proprietary information without client approval.

•

We will serve our clients with integrity, competence and objectivity.

•

We will keep client information and records confidential and not use proprietary information without client approval.

•

We will accept only engagements for which we are qualified by our experience and competence.

•

We will assign staff to client engagements in accord with their experience, knowledge and expertise.

•

We will acknowledge any influences on our objectivity and will withdraw from an engagement when our objectivity or integrity may be impaired.

•

We will charge fees and expenses that are reasonable, legitimate, and commensurate with the services we deliver and responsibility we accept.

•

We will respect the intellectual property rights of our clients.

Client Services Assurances

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved

Most viewed publications (click to link to each):

•

The U.S. DoL ETA Home Page. Includes sections for business and industry, workforce professionals, grants, a portal to the WIA One Stop career system, Job Corps, Jobs for Veterans, My Skills, My Future, My Next Move, benefits.gov, the Worker Reemplyment Project, WIA contacts and national WIB database. (Select Fall 2012 links below)

Workforce Development - Client Technical Assistance

Workforce Policy Briefs of Interest

•

U.S. DoL ETA Foreign Labor Certification Page. Includes all forms for foreign labor certification, current foreign labor performance reports and current news updates on waivers and extensions.

•

Workpermit's Workpermits H-1B Visa TA Page. Includes links on all other types of work permits and visas accepted in the U.S. as well as rules for employers in the U.S. and the world.

•

WorkForce21 Development Series Publication “CareerWorks Model”

•

WorkForce21 Development Series Publication “Enhanced Health Support Specialist National Apprenticeship Summary”

•

WorkForce21 Development Series Publication “Health Support Specialist Curriculum”

•

WorkForce21 Development Series Publication “Report on Outcome Metrics: LTC Apprenticeship Programs”

•

•

"LTC Challenges and Opportunities for Employee Recruitment and Retention: Nebraska",

Michael D. Van Stine

Michael D. Van Stine

•

"Putting Welfare Reform to Work", AHCA Provider Magazine, October, 2000, Michael D. Van Stine

•

Health Care Trends: "Staffing Issues Critical", Michael D. Van Stine

•

"The Impact of Welfare Reform to Employers", Michael D. Van Stine

Employee Transportation

•

Child Care

Mentoring

Health Care/Eldercare

•

Health Care Industry: Identifying and Addressing Workforce Challenges, U.S. DoL-ETA 2004

•

2009 Nursing Facility Staff Retention and Turnover Survey, American Health Care Association, 2011

•

Pennsylvania's Frontline Workers in Long-Term Care: The Provider Organization Perspective, Executive, Executive Summary, prepared by the Polisher Research Institute at the Philadelphia Geriatric Center, describes the results of 900 interviews with administrators of long-term care provider organizations. The full report is available here.

•

In Their Own Words -- Pennsylvania's Frontline Workers in Long-Term Care, prepared by Dostalik ET AL, reports on the results of 15 focus groups with direct-care workers across the state. The reports outline various concerns of direct-care workers and administrators of long-term care. Some of these issues include workplace environment, training, benefits, regulations and enforcement, wages, and society's perceptions. The reports also describe the extent and nature of recruitment and retention issues; a review of professional literature; and how other states have addressed this problem.

•

"Staffing of Nursing Services in Long Term Care: Present Issues and Prospects for the future" American Health Care Association, 2001

•

Issue Brief: Workforce Shortage, Lutheran Services, 2005

Fatherhood

•

"Can Low-Income Single Parents Move Up in the Labor Market? Finding from the Employment Retention and Advancement Project" Cynthia Miller, Victoria Deitch, and Aaron Hill, 2011

•

Regional Workforce Partnership past released Workforce 2001 an extensive study of the Philadelphia region's workforce composition. RWP no longer active; older data. However, excellent format for other regions to follow.

•

Private Employers and TANF Recipients, Final Report, US DHHS, 2004

•

•

"Creating Subsidized Employment Opportunities for Low-Income Parents: The Legacy of the TANF Emergency Fund" LaDonna Pavetti, CBPP, Liz Schott, CBPP, Elizabeth Lower-Basch, CLASP, 2011

•

"Jobs for Welfare Recipients" W.E. Upjohn Institute for Employment Research Employment Research Timothy J. Bartik, 1997

•

"Job Creation Tax Credits and Job Growth: Whether, When, and Where?" Working Paper 2010-25, Federal Reserve Bank of San Francisco, 2010

•

"Broke But Not Deadbeat: Reconnecting Low Income Fathers and Children" (August 1999) Understanding the barriers that low-income fathers encounter, examples of program models and an evaluation of the Parents' Fair Share Demostration.

•

The Federal Office of Child Support Enforcement Home Page Links directly to state systems, quarterly updates, news and a host of related and relevant links.

•

National Center on Fathers and Families, U of PA - A Best Site! Note their "FatherLit Database", BAyFIDS and Fatherhood Indicators Framework Project!

Microenterprise

•

Updated Section Coming Soon!

Organizational Change

•

Renewal & Crisis Management is an organization dedicated to all areas of Corporate Renewal and Remediation.

•

Summary of Key Points: "The Spirit to Serve - Marriott's Way" (1997) by J.W. (Bill) Marriott, Jr. and Kathi Ann Brown, HarperBusiness, HarperCollins.

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved

Workforce21 Briefs and Articles

•

NEW! 2012 HHS Poverty Guidelines - Poverty Guidelines are issued each year by the U.S. Department of Health and Human Services (HHS). The guidelines are a simplification of the poverty thresholds for use for administrative purposes - for instance, determining financial eligibility for certain federal programs. Includes full text of the Federal Register notice with the 2012 poverty quidelines.

•

NEW! 2012 DOL LLSIL Guidelines - Lower Living Standard Income Level (LLSIL) guidelines are issued each year by the U.S. Department of Labor. The guidelines are a standardization of low-income thresholds for use for various administrative purposes and social service planning/evaluation.

•

NEW! BLS National Compensation Survey (2012 - most recent) Charts and graphs data on occupational wages for localities, broad qeographic regions, and the nation. Includes data on employee benefits in the U.S.; Employment Cost Index (ECI); Employer Costs for Employee Compensation (ECEC); and current NCS News releases.

•

NEW! BLS Occupational Outlook Handbook (2010-2020) Projects top 20 growth occupations in detail a/o May 29,2012

•

NEW! The 30 Occupations with the Largest Projected Growth (2010-2020) Projects top 30 growth occupations in a snapshot a/o February 1,2012

•

NEW! Unemployment Rates for States a/o November 20, 2012

•

UPDATED FOR 2012! MDRC - Manpower Development Research Center Publications Page Most recent publications (click to link to each):

U.S. Department of Labor National E&T Best Practices and Educational Tools Clearinghouse

The National Workforce Association

The National Association of Workforce Boards

The National Governors Association

The Urban Institute

Center for Law and Social Policy

The American Health Care Association

The National Association of Home Care & Hospice

Leading Age: The National Non-Profit HC Association

Institute for Caregiver Education

The National Council on Aging

American Society on Aging

Goodwill of Southern NJ/Quaker City

National Association of State Workforce Agencies

QE Foundation

WorkForce21, its parent Workforce Centers of America Inc. and/or Workforce Endeavors, LLC, to not specifically endorse any of the positions or services offered by companion or affiliate organizations. We offer this list as direction to those sites that we see as most helpful to clients based on concise and useful workforce related information.

Let us know if you have any questions or comments regarding referral organizations.

The National Workforce Association

The National Association of Workforce Boards

The National Governors Association

The Urban Institute

Center for Law and Social Policy

The American Health Care Association

The National Association of Home Care & Hospice

Leading Age: The National Non-Profit HC Association

Institute for Caregiver Education

The National Council on Aging

American Society on Aging

Goodwill of Southern NJ/Quaker City

National Association of State Workforce Agencies

QE Foundation

WorkForce21, its parent Workforce Centers of America Inc. and/or Workforce Endeavors, LLC, to not specifically endorse any of the positions or services offered by companion or affiliate organizations. We offer this list as direction to those sites that we see as most helpful to clients based on concise and useful workforce related information.

Let us know if you have any questions or comments regarding referral organizations.

© 2000-2016 Workforce21.net All rights reserved

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

•

The American Health Care Association

•

Leading Edge (formerly AAHSA)

•

Connecticut Association of Health Care Facilities

•

Delaware Health Care Facilities Association

•

Leading Edge PA (formerly PANPHA)

•

Missouri Health Care Association

•

Nebraska Health Care Association

•

Health Care Association of New Jersey

•

New York State Health Facilities Association

•

Geriatric & Medical Companies, Inc.

•

Genesis Health Care Corporation (formerly Genesis Health Ventures)

•

Golden Living (formerly Beverly Healthcare)

•

National Workforce Association (as an advisory board member)

•

Health1st Home Care Services

•

SpectraCare Home Care Services

•

Community Care & Development Corporation

•

Mohawk Community Investments

© 2000-2016 Workforce21.net All rights reserved

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

•

Michael D. Van Stine, Chairman

•

Manuel Nunez, Member

•

Rita Adeniran, Member

•

Grace Egan, Member

•

George Ricci, Member

•

Manuel Nunez, Vice President and CFO/CIO

•

Fran Clark, RN, Director, Educational Services

•

Elizabeth Kuptas-Badurina, Office Manager

Click on Staff Name for Profile

Board Members

Staff Members

We welcome your feedback! We are always happy to answer any questions you may have about workforce issues or products and services. Please feel free to fill out this form. If you pose a question, or simply would like more information on any of our client services, one of our customer service representatives will either get you an answer quickly or direct you to other helpful resources.

You can also call or FAX us at our inquiry hotline (856) 401-0424 or send an e-mail to: mail@workforce21.net or write to:

WorkForce21

777 Blackwood Clementon Road

Suite E

Lindenwold, NJ 08021

Thanks for visiting with us!

You can also call or FAX us at our inquiry hotline (856) 401-0424 or send an e-mail to: mail@workforce21.net or write to:

WorkForce21

777 Blackwood Clementon Road

Suite E

Lindenwold, NJ 08021

Thanks for visiting with us!

Contact Us - Phone/FAX: (856) 401-0424 or E-Mail mail@workforce21.net or write: 777 Blackwood Clementon Road Suite E Laurel Springs, NJ. 08021

© 2000-2016 Workforce21.net All rights reserved